A Gift of Real Estate

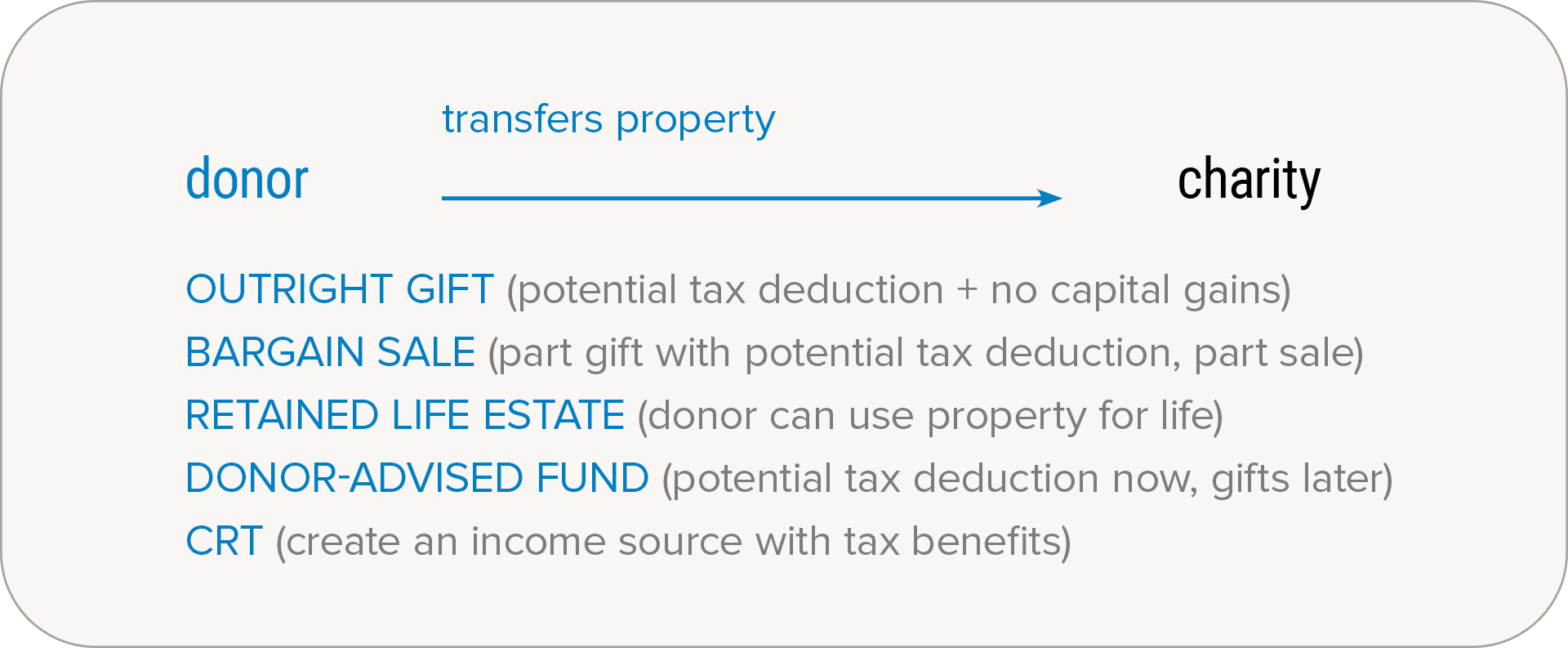

With a gift of real estate, you have several options for making a tax-efficient gift using property you no longer want.

OPTION 1—an outright gift of appreciated property

You may find this is a straightforward and tax-wise way to meet multiple planning goals. It works like this:

- You obtain a qualified appraisal of the property. (This is necessary to establish the property’s fair market value.)

- You donate the appreciated property to us within 60 days of the appraisal.

- Your gift may qualify for a federal income tax charitable deduction (if you itemize) for the property’s full fair market value. Your deduction in any one tax year is limited to 30% of your adjusted gross income, but any unused deduction amount can be carried over to up to five years.

- You will owe no capital gains tax on the property (as you would have with a sale).

What about mortgaged property?

Mortgaged property tends to be a problematic gift asset. Usually, the best solution is to pay off the mortgage before donating the property. If this is your situation, reach out to us and/or talk to your attorney to figure out the best way to proceed.

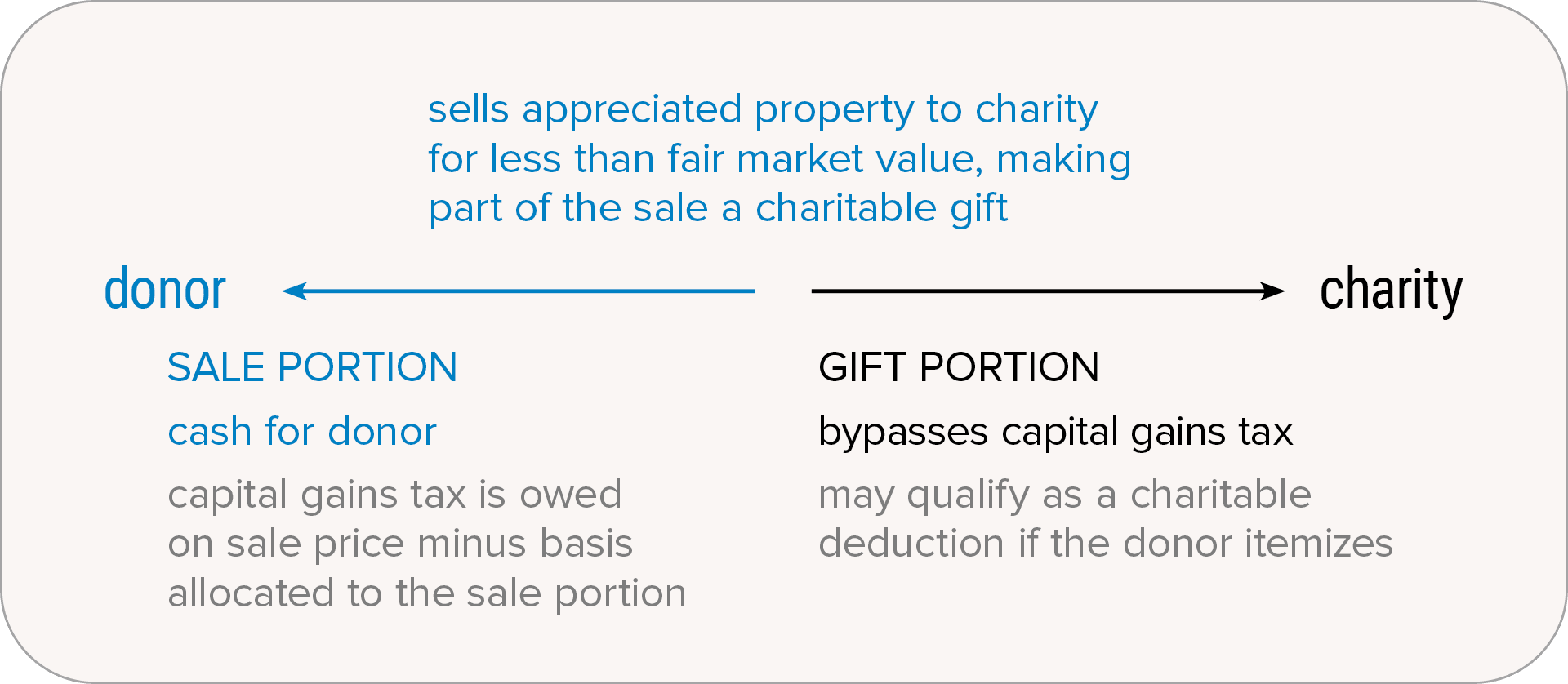

OPTION 2—a bargain sale

You may find this option useful if you are ready to dispose of your property but aren’t in a position to give it away. A bargain sale is part gift and part sale, and therefore provides both a current federal income tax deduction and proceeds from the sale of the property. It works like this:

- You sell the property to us for less than its full fair market value—for example, if you sell us a property appraised at $500,000 for only $200,000.

- In the above scenario, you receive the $200,000 sale price, but you also make a $300,000 gift to us.

- The gift portion may qualify for an income tax charitable deduction.

- No capital gains tax is due on the gift portion.

OPTION 3—a gift of a remainder interest

You may find this is the perfect solution if you could use an income tax deduction now but would like to continue to use and/or occupy the personal residence or farm for the rest of your life. It works like this:

- You enter into an arrangement with Citizens & Scholars under which the property will be irrevocably transferred to us at the time of your death.

- You retain a “life estate” that gives you the right to live on or use the property throughout your lifetime.

- Even though the gift doesn’t actually take place until later, because it is irrevocable, your gift may qualify for an immediate income tax deduction for the discounted present value of our future interest in the property (essentially, the value of the land and improvements reduced by the value of your lifetime use of the property).

- If, after making a gift of a remainder interest, you decide you no longer need the property, you can choose to donate your life estate and receive an additional charitable deduction at that point. (Note that there will be issues with this option if it appears to the IRS that you planned to do this all along.)

OPTION 4—a gift to establish a charitable remainder trust

You may find this to be a helpful option if you want to get rid of your property and establish an income stream to supplement other forms of retirement income. It works like this:

- You give your property to establish a charitable remainder trust (CRT).

- At the time the trust is funded, you qualify for a tax deduction for the present value of the remainder interest expected to go to us at the end of the trust term.

- The trustee can then invest the sale proceeds and use the money to make regular income payments to you and/or your named income beneficiaries for life or for a stated term of years.

- At the end of the trust term, the remaining trust assets will pass to Citizens & Scholars.

Evaluate the fit.

A gift of real estate may be a particularly good option to consider if you:

- Own appreciated property (residential, commercial, or undeveloped land) you no longer wish to use or maintain

- Would like to get rid of your property while reducing or even eliminating any capital gains tax on the appreciation

- Could use a charitable tax deduction

- Want to use your property to establish an income stream

- Are willing to put in a bit more time and effort in order to use this asset to meet both financial and charitable goals in a tax-efficient manner

See how it works.

Scott and Robin’s vacation cottage, once a family joy, has become a burden. They thought about selling the property and giving the proceeds to Citizens & Scholars, but when they learned that we would accept the cottage as an outright gift, it was an ideal solution. Scott and Robin itemized in order to receive a federal income tax deduction (with a qualified appraisal and subject to limitations), eliminated the cost and hassle of a sale, and owed no capital gains tax on the property’s significant appreciation. We then sold the cottage and put the full amount of the proceeds to work supporting our fellowships and programs—as a qualified charity, we did not owe any capital gains tax on the sale.

Maria paid $100,000 for land that is now worth $500,000—property she no longer wants. After discussions with us and her attorney, Maria decides to sell it to Citizens & Scholars for $300,000. She receives some much-needed cash and makes a gift of the remaining $200,000. No capital gains tax is due on the gift portion, and she may qualify for a charitable income tax deduction for the full $200,000 gift amount.

Consider your timing.

If you want to qualify for an income tax charitable deduction this year, you should plan to begin the process no later than early November, as real estate gifts can take some time to complete.

We can help.

Gifts of real estate tend to be more involved than gifts of other assets, and we are here to help. Start with a discussion—we must ensure that the gift property is marketable and that we can accept it. If the property is a good fit, we can help you:

- Explore the options mentioned here, along with other gift ideas (for example, oil or water rights gifts, qualified conservation contributions, funding for a donor-advised fund, etc.)

- Ensure your gift meets all legal requirements by working together with your attorney (failing to meet all legal requirements can result in the loss of important tax benefits)

Remember that we will need to conduct a title search and property inspection, and you will need to obtain a qualified appraisal if you wish to claim a charitable income tax deduction for your gift.