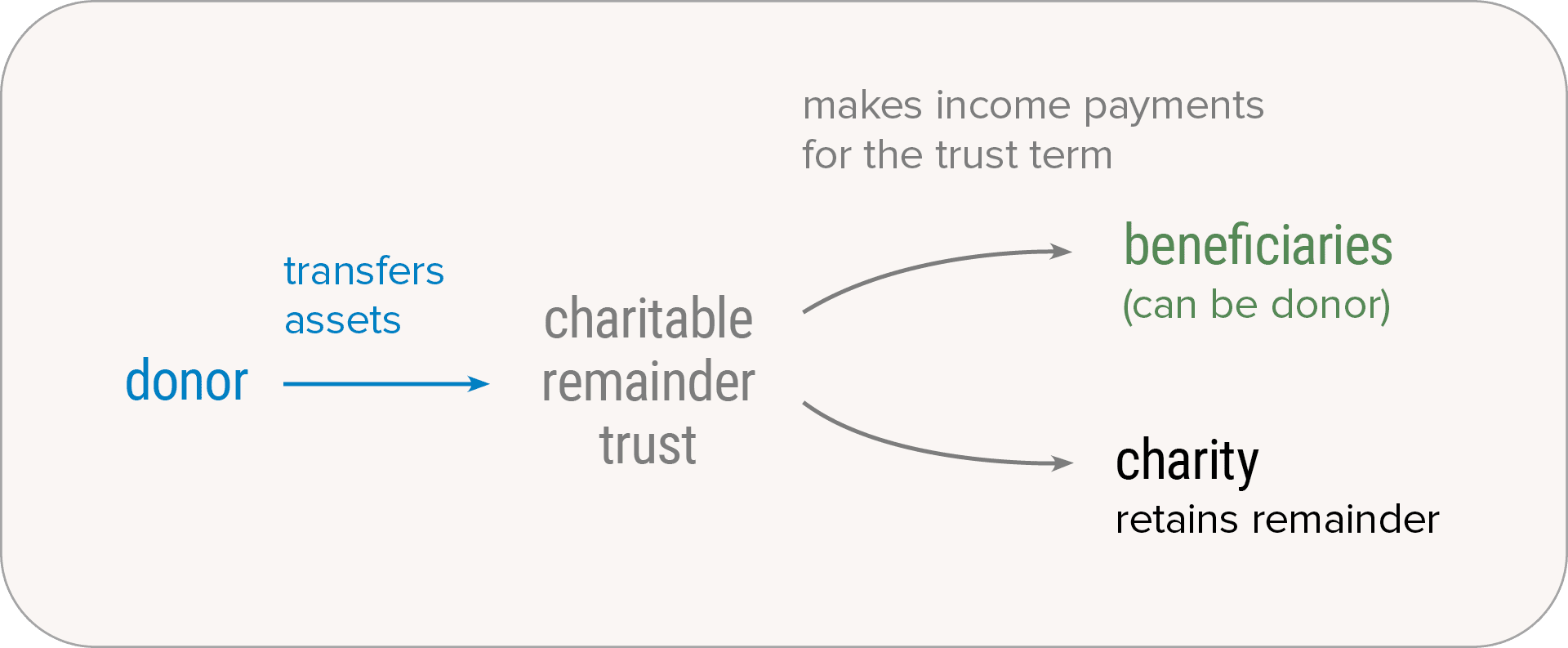

Charitable Remainder Trusts

Charitable remainder trusts (CRTs) provide income payments before passing remaining assets to charity.

You may find that while there is slightly more effort and expense involved in setting up a trust, it can be an extremely useful and flexible way to:

- Reduce federal income taxes

- Convert appreciated assets into a lifetime income stream

- Bypass the capital gains tax

- Benefit Citizens & Scholars and other personally meaningful charities

- Make a gift now or in your will

It works like this:

- You transfer money or property to the irrevocable trust (often non-producing appreciated property held for over one year), removing the property from your estate.

- You pay no capital gains tax on the transfer.

- You may qualify for an immediate federal income tax deduction (if you itemize) for our estimated remainder interest.

- You name the income beneficiaries—yourself, your spouse, or anyone you choose.

- The trustee manages the assets and pays out an income for life or for a set number of years (up to 20) to you and/or other named beneficiaries. Income payments typically equal 5% of the trust value, but you can set the amount within legal limits.

- At the end of the trust term, the trust pays out the remaining assets to us (or other named charitable beneficiaries).

Comparing a CRAT and a CRUT

As noted above, there are two main types of charitable remainder trusts—a charitable remainder annuity trust (CRAT) and a charitable remainder unitrust (CRUT). There are two main differences:

- Income payments. A CRAT offers a fixed payment that is a percentage of the initial assets in the trust. This provides a steady, reliable income stream and can be a good way to lock in a high interest rate. A CRUT offers a variable payment amount that is a percentage of the trust assets as revalued annually. This serves as a hedge against inflation.

- Flexibility. A CRAT comes in just one form and cannot accept additional contributions. A CRUT is more flexible—it comes in four different types and can accept additional contributions.

Evaluate the fit.

A CRT may be a particularly good option to consider if you want to:

- Make a major gift and potentially gain immediate federal income tax benefits, all without a loss of spendable income

- Make a significant property gift but don’t want to lose the income produced by the asset

- Convert an appreciated asset into an income stream

If you want to provide for your family and us after your death, a CRUT you create in your will (often called a “give it twice” trust) is worth considering.

Read more about a “give it twice” trust. A “give it twice” trust, officially known as a testamentary CRUT, lets you provide for your family after your death and then support our important mission. It works like this: HIDE

See how it works.

Ginny transfers highly appreciated assets worth $400,000 to a charitable remainder trust, specifying that $20,000 will be paid to her each year for as long as she lives. When Ginny dies, the remaining property in the trust will be distributed to Citizens & Scholars. By using a CRT to make her gift to us, Ginny receives a few important benefits:

- An annual income of $20,000 for life

- An immediate and substantial income tax deduction if she itemizes (subject to limitations)

- No capital gains tax due when she transfers the appreciated property to the trust or even when the trustee sells the property to fund the income payments

A new funding option

Note that an IRA owner age 70½ or older can choose to fund a new CRT by making a one-time, tax-free distribution from the IRA of up to $53,000 (in 2024). (Spouses may combine their distributions from their own IRAs into a single CRT.) This distribution does not create a charitable income tax deduction, but it does count toward the donor's required minimum distribution if one is due. A CRT created this way has slightly different rules than a regular CRT.

Consider your timing.

If you want to qualify for a charitable deduction this year, you should initiate the transfer of the assets to the trust as early as November to ensure everything is properly established by the end of the year.

We can help.

We would be happy to discuss how you can tailor a charitable remainder trust to meet your personal or family needs. We can also provide you with the estimated charitable income tax deduction that would be available for your gift (the amount depends partly on the applicable federal rate, which changes every month), as well as the estimated income payment amount.