Beneficiary Designations

With a charitable beneficiary designation, you can make a simple future gift that costs you nothing today.

You may find that designating a charitable gift that you can change is a comfortable, powerful way to make a meaningful gift while keeping control of the gift property during your life. The following assets can pass directly by beneficiary designation and not under your will:

- Life insurance policies

- IRAs and other retirement accounts

- Donor-advised funds (allowable for some DAFs, but not all)

- Bank accounts (through a payable on death or POD designation)

- Stock and mutual fund shares (through a transfer on death or TOD designation)

- Real estate (through a transfer on death or TOD designation, allowable in more than half of US states)

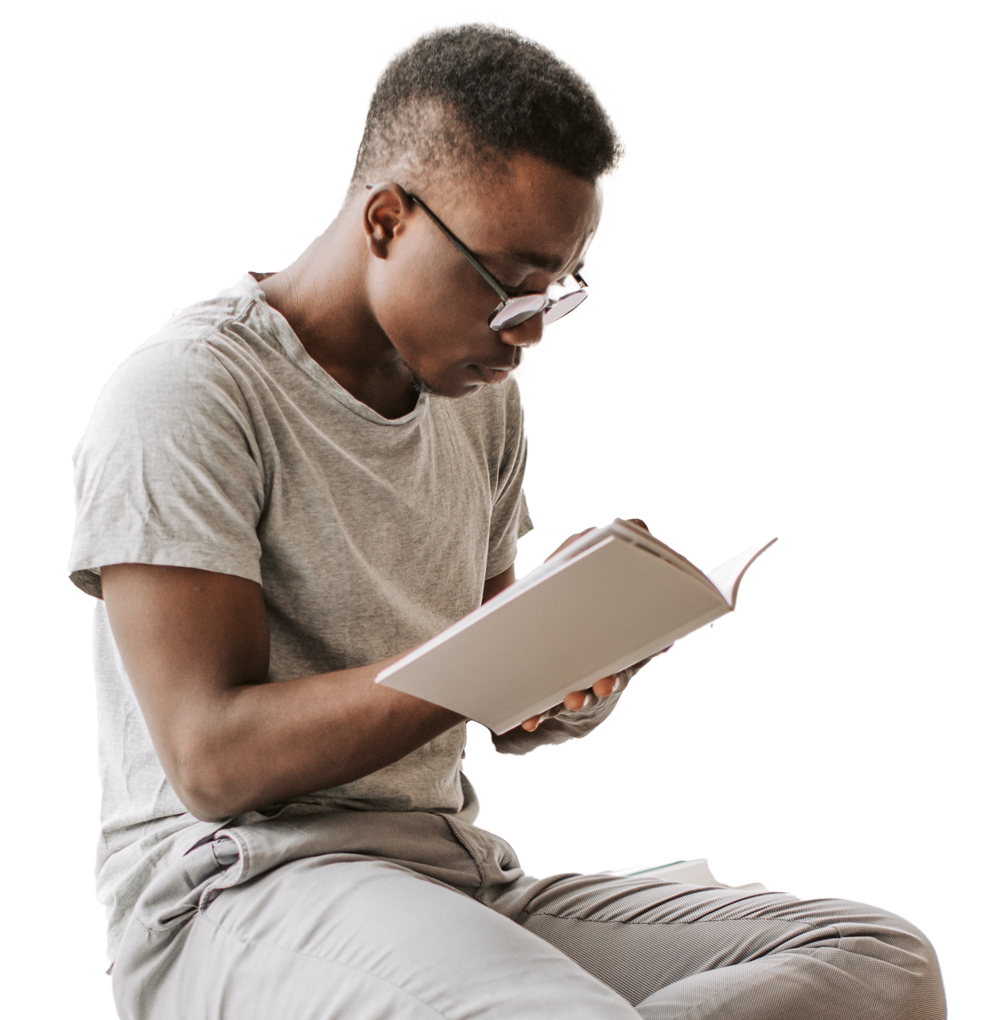

A charitable beneficiary designation works like this:

- You name us to receive the remaining assets or proceeds at the time of your death. You can do this at the time you purchase the asset or set up the fund or account, or you can easily create or change beneficiary designations using a change-of-beneficiary form.

- You can choose to name us as the sole beneficiary, a percentage beneficiary (along with one or more heirs or other charitable beneficiaries), or a contingent beneficiary (to receive the assets only if the primary beneficiary cannot).

- We have no rights to the asset/fund/account during your lifetime—we will only receive assets at the time of your death.

- The beneficiary designation is revocable, meaning you can remove or change it at any point during your life.

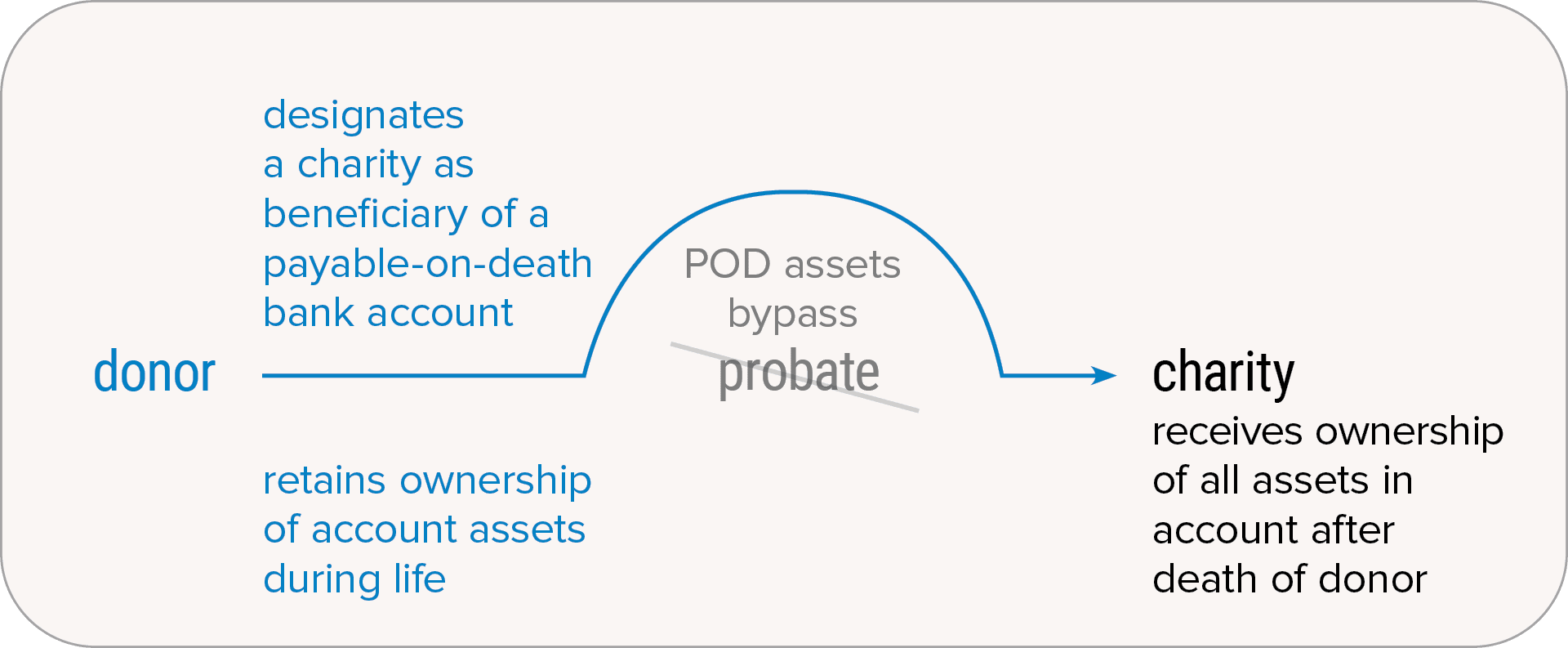

- Some financial accounts or assets typically pass by will but can pass directly to a named beneficiary if you opt to complete a form to set up a payable on death (POD) or transfer on death (TOD) designation.

Your will controls most of your property, but not all.

If you would like to make a similarly easy, flexible, revocable gift of other assets not named here, consider making a gift in your will.

Evaluate the fit.

A charitable beneficiary designation may be a particularly good option to consider if you:

- Want to make a substantial gift but don’t want to commit the assets right now

- Want the ability to continue to use the assets during your life

- Want the peace of mind that comes from knowing you can change the size of the gift (or revoke your gift) if your needs or goals change

See how it works.

Years ago, when David’s wife died, he filed a Change of Beneficiary form on his life insurance policy, making his two grown children the primary beneficiaries and Citizens & Scholars a contingent beneficiary (to receive the proceeds only if his children could not). Now, both children are married with families of their own and are doing well financially. David plans to leave other assets to them and makes us the sole beneficiary of his life insurance policy. This allows him to meet his charitable goals while still retaining all his assets for use during retirement. In addition, he knows that if his situation changes, he can easily make another beneficiary change.

Carla adds a payable on death (POD) designation to her checking account and names Citizens & Scholars as the beneficiary. She retains complete control of the account and can change the beneficiary designation again at any time during her life. While the FDIC insures her other accounts and CDs at the same bank for a combined total of $250,000, her POD account has its own $250,000 coverage. At Carla’s death, Citizens & Scholars must provide a certified copy of her death certificate to claim the money that remains in the account, which will then pass directly from the bank to us without going through probate.

Consider your timing.

Because no federal income tax charitable deduction is available for this type of future gift, you can create or change a charitable beneficiary designation at any time that works for you.

We can help.

We can answer any questions you may have about this gift option. If you have already named us as the beneficiary of an asset or account, please let us know.

We appreciate you including us in your planning.

Using a beneficiary designation to make a gift to Citizens & Scholars qualifies you for membership in the Fellows Legacy Society. This is our way to thank you for supporting our future as your plan for yours. Read more about the Fellows Legacy Society.