Charitable Lead Trusts

Charitable lead trusts provide annual payments to Citizens & Scholars before passing remaining assets to family or other named beneficiaries (or even back to you).

You may find that while there is slightly more effort and expense involved in setting up a trust, it can be an extremely useful and flexible way to:

- Provide significant support to Citizens & Scholars over time

- Reduce or even eliminate the taxes customarily due on the transfer of wealth to loved ones

- Qualify for a deduction for gift and estate tax purposes

NOTE: Creating a charitable lead trust during a period of low interest rates will mean even greater savings in transfer taxes.

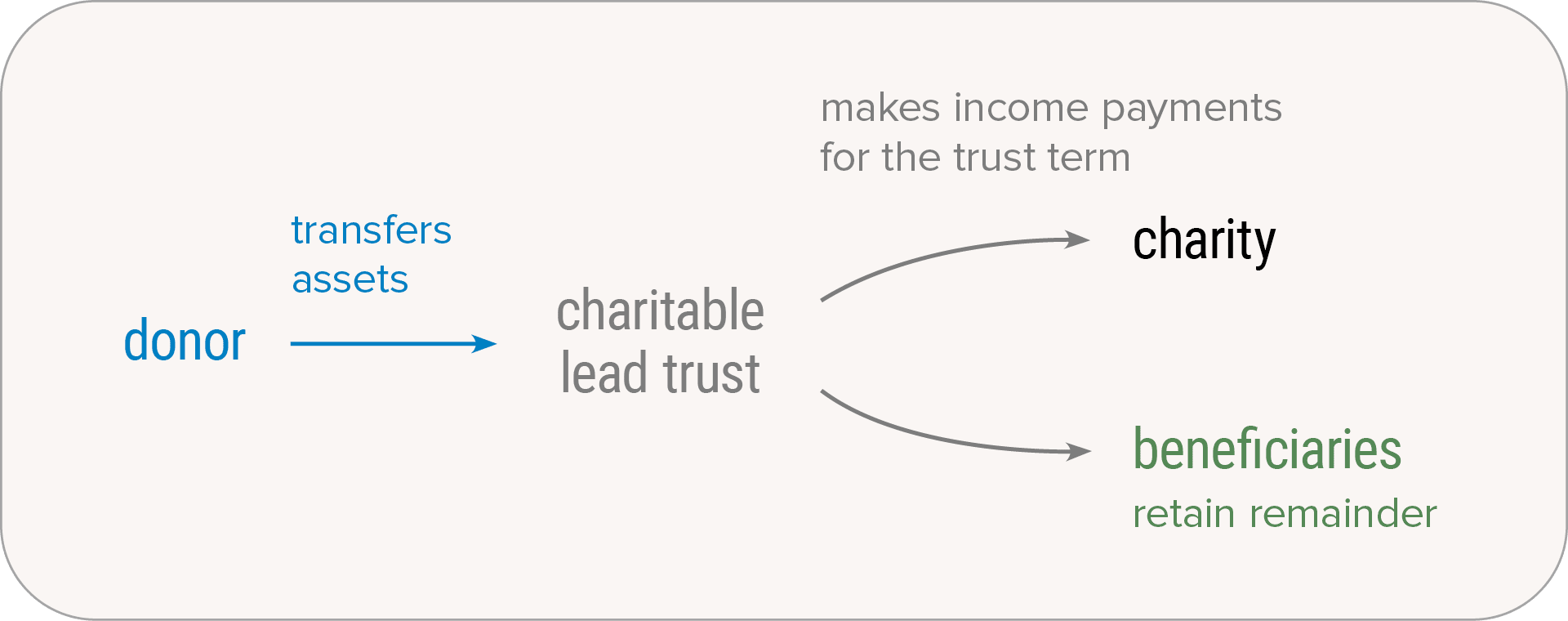

A charitable lead trust (CLT) works like this:

- You transfer money or property to the irrevocable trust (often marketable securities with strong growth potential).

- You name us as the charitable income beneficiary, and you choose who will receive the remaining assets at the end of the trust term.

- The trustee provides careful asset management and pays out annual gifts to us for a set number of years or for your lifetime. Gifts can be a fixed dollar amount or a fixed percentage of trust assets as revalued each year.

- At the end of the trust term, the trust pays out the remaining assets to family members. (You can choose to have the remaining assets given back to you, but this type of trust is less common and has different tax treatment.)

What are the tax benefits?

- Pass more wealth to loved ones. The assets in a charitable lead trust may increase in value over the course of the trust term—possibly by a significant amount. If so, no tax is due on the appreciation.

- Minimize estate and gift taxes. The size of the deduction for gift and estate tax purposes is based on the amount paid to charity, the length of the trust term, and the applicable federal rate at the time you establish the trust.

Evaluate the fit.

A CLT may be a particularly good option to consider if you want to:

- Pass more wealth to heirs and are comfortable enough to make a substantial financial commitment over a long period of time

- Make an extended impact on Citizens & Scholars with significant annual gifts

- Minimize federal gift and estate taxes

See how it works.

Jackie transfers stock with strong growth potential into a CLT. The trust makes annual payments to Citizens & Scholars for the rest of Jackie’s life. When Jackie passes away, the remaining trust assets pass to her three grown children in equal parts. Since the value of the remainder interest is calculated at the time she created the trust, the children are not taxed on the stock’s significant appreciation over the many years it was held in the trust.

Consider your timing.

Because a CLT does not qualify for a federal income tax charitable deduction, you can create the trust at any time that works best for you.

We can help.

We would be happy to discuss how you can tailor a charitable lead trust to meet your charitable and family needs.