Endowment Gifts

A gift to an endowment fund is one of the strongest ways to maximize your impact.

You may find that an endowment gift is the best way to support our mission on a long-term (often permanent) basis. It is a particularly powerful way to sustain our work because:

- It provides support during times of change and challenge.

- It facilitates long-term planning and program expansion.

- It can ensure the continuation of a particular program or fellowship.

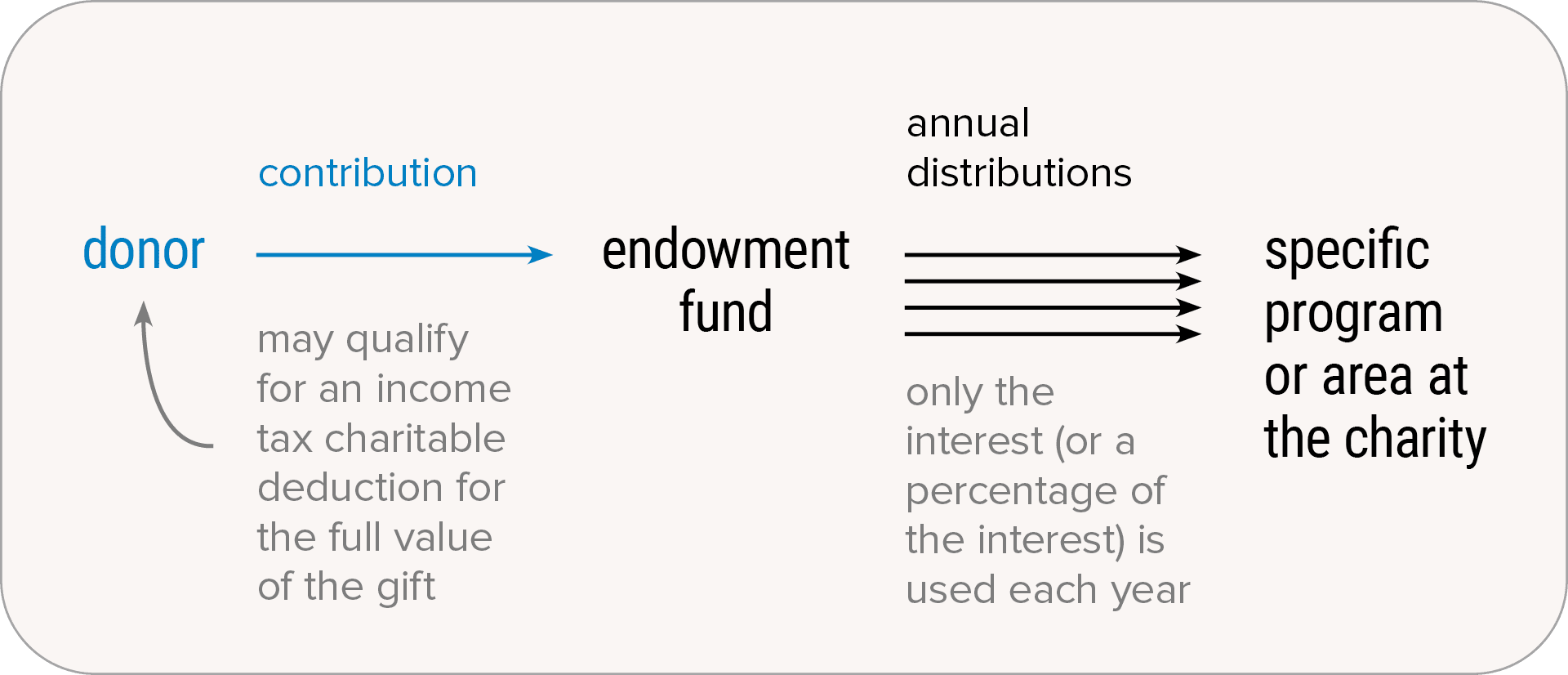

An endowment gift works like this:

- You transfer money or property to an existing endowment fund now or make a gift to the endowment fund in your will or through a beneficiary designation.

- You choose a fund established to support a program or fellowship close to your heart or a fund that supports our general mission.

- You qualify for a charitable income tax deduction at the time of your gift (assuming you itemize and subject to limitations).

- The endowment fund combines your gift with the gifts of others, utilizing professional asset management to invest for growth.

- Only the income (or a stated percentage of the income) from the fund is used each year to support the designated program or area, meaning your gift becomes perpetual and self-renewing. This increases your impact and helps us accomplish our mission far into the future.

Establishing an endowment fund

Contributing to an existing endowment fund is an easy and meaningful way to make a lasting impact—but it’s not the only way. If you would like to make a large, legacy-creating gift with a sizable cash donation or, more often, with a significant gift in your will, you can create your own endowment fund. This gives you the freedom to support and sustain the area that means the most to you. If this idea interests you, please reach out to us so we can start a conversation about how to best meet your charitable goals.

Evaluate the fit.

A gift to an endowment fund may be a particularly good option to consider if you want to:

- Qualify for a charitable income tax deduction (subject to limitations)

- Ensure the continuation of a particular part of our mission (say, a specific program or fellowship)

- Make a lasting impact on Citizens & Scholars

- Help ensure that we have a steady level of support that can help us remain fully active during difficult economic times

See how it works.

Naomi, age 80, has given Citizens & Scholars regular annual gifts of $1,200 since she retired at age 65. This year, however, she’s been thinking about her legacy. She decides to make a $25,000 gift to our endowment fund in memory of her late husband, Ken. Not only will her gift generate approximately the same annual donation ($1,250, assuming fund earnings of 5%), but Naomi knows her gift will help sustain programs and fellowships that meant a lot to Ken.

Because she is also passionate about Citizens & Scholars, Naomi talks to her family and friends about her gift. Several of them make their own contributions to the endowment in Ken’s memory, creating an even more powerful and lasting impact.

Consider your timing.

While you can contribute to an existing endowment fund easily at any time, creating a new fund will take longer.

We can help.

We would love to help you determine the best way to provide long-term support for the parts of our mission that mean the most to you. Please reach out to start a discussion!