Donor-Advised Fund

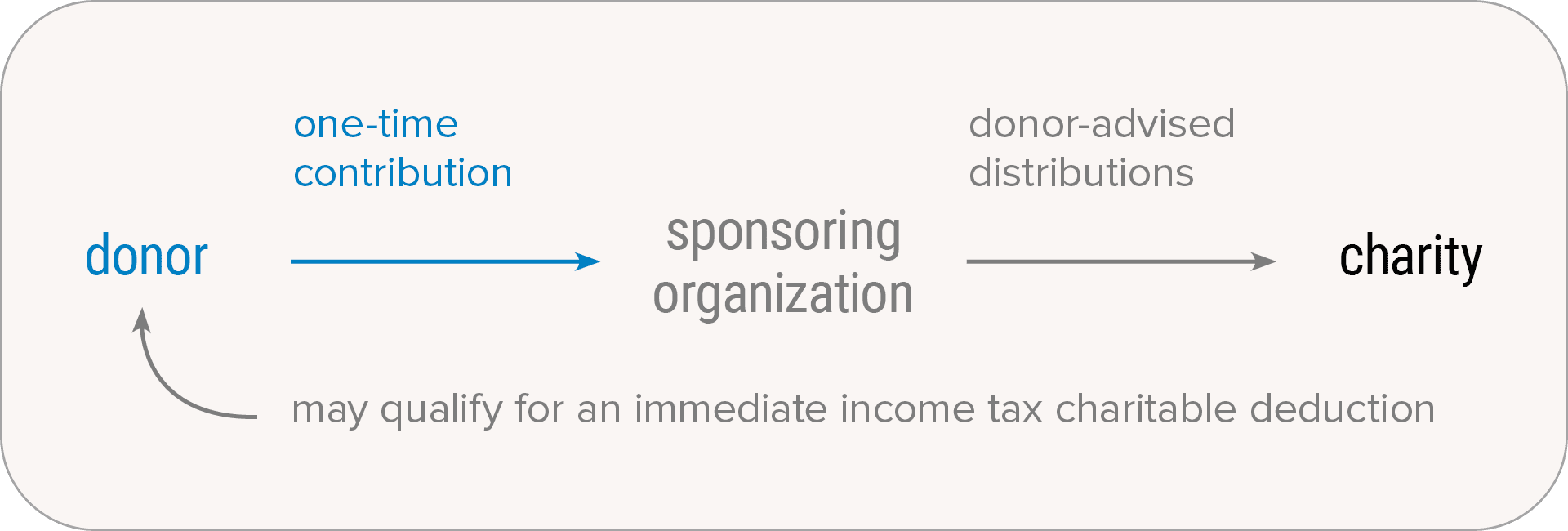

With a donor-advised fund (DAF), you can make a gift now, receive a current income tax deduction, and retain the flexibility to recommend gifts later when the time is right.

You may find that using a DAF provides a simple, meaningful way to benefit Citizens & Scholars and other charities you support. Consider the following:

- You establish a DAF with a single donation and can make additional donations later if you wish. Most DAFs will accept assets beyond cash and securities, sometimes including real estate, cryptocurrency, or closely held stock.

- The donor-advised fund then owns those assets and administers the fund—you no longer need to manage the money.

- This arrangement allows you to qualify for an immediate charitable income tax deduction for the amount contributed to the DAF, even though the money hasn’t been distributed to charity yet.

- You have advisory privileges, meaning that at some point in the future, you can recommend (but not require) gifts to be distributed to specific charities.

Evaluate the fit.

Donor-advised funds may be a particularly good option to consider if you:

- Want to make a large, tax-deductible contribution this year (subject to limitations) to offset increased income

- Haven’t yet fully established your charitable goals, so would like flexibility in making future gifts

- Would find it beneficial to segment your charitable funds from your other assets

- Would like to donate a more complex non-cash asset that your intended charitable recipient(s) cannot accept

See how it works.

Five years ago, Daniel earned a significant year-end bonus. He knew he wanted to use that money for a charitable purpose, but he wasn’t yet sure where he wanted to have an impact, and he had little time to decide. He chose to donate the full amount to a DAF, which qualified him for an immediate and much-needed charitable income tax deduction (subject to limitations). The DAF invested the assets and retained ultimate authority over any distributions.

This year, Daniel had a colleague whose nephew was the recipient of a fellowship from Citizens & Scholars, and Daniel saw firsthand the impact that had on the young man and the community. Daniel uses his advisory privileges to recommend a grant from the DAF to Citizens & Scholars to help fund that particular fellowship going forward. The DAF distributes the recommended gift to us (they are not obligated to do so, but will strongly consider following Daniel's recommendations).

Consider your timing.

If you want to qualify for a charitable deduction this year, you should initiate your gift by Friday, December 12, 2025.

We can help.

We can provide you with more information about donor-advised funds and grants to our organization.