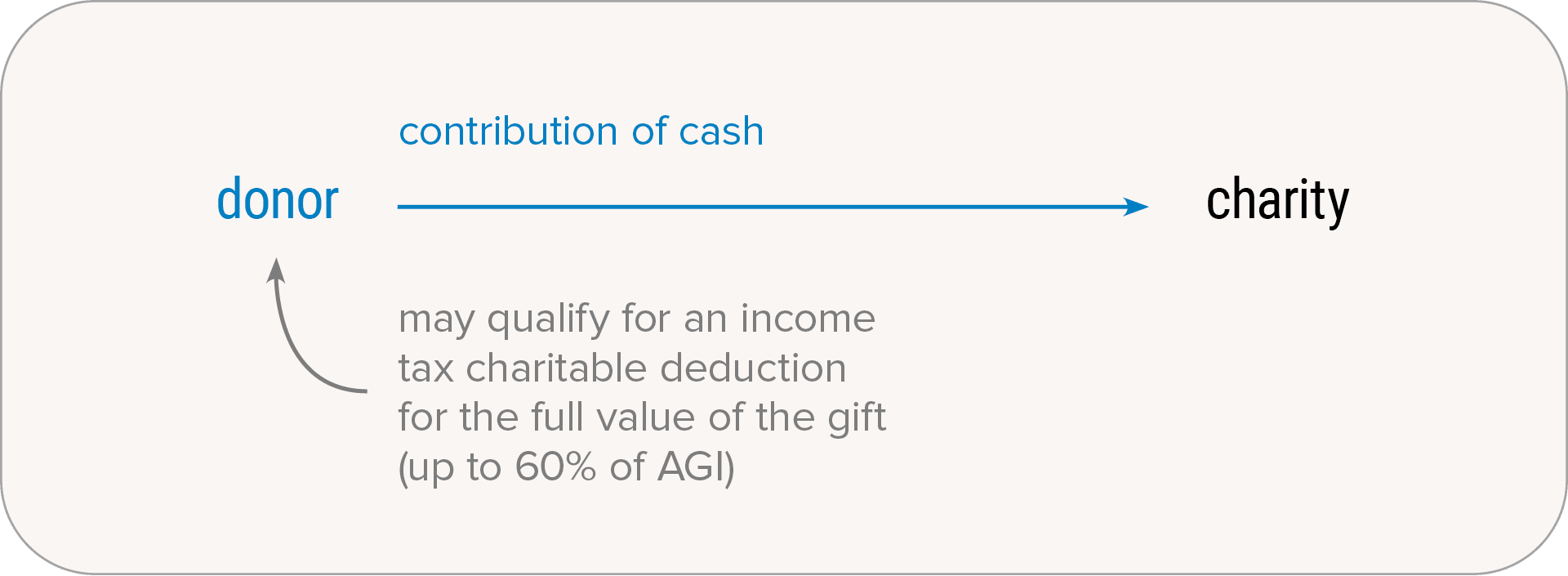

A Gift of Cash

With a gift of cash, you can make a simple gift and qualify for an income tax charitable deduction.

There’s a reason cash gifts are so popular! Consider the following:

- Your gift (cash, check, or credit card) will make an immediate impact on our important work.

- The full amount of your gift may be tax deductible if you itemize—your actual tax savings depends on the amount of your gift and your marginal income tax bracket.

- While you cannot deduct more than 60% of your federal adjusted gross income in the year of the gift, you can carry over any excess charitable deduction for up to five years.

- Because so many donors make cash gifts every year, the combined impact is an extremely significant and vital part of our ongoing work.

Will you itemize your taxes this year?

Many people are making use of today’s high standard deduction instead of itemizing. However, if you want the income tax deduction associated with a charitable gift of cash, you’ll need to itemize.

You may want to consider “bunching” your donations. Essentially, this means making two or more years’ worth of charitable gifts in one year to make itemizing worthwhile. Your advisors can help you determine if this is a good approach.

Evaluate the fit.

A cash gift is a good option if you:

- Received extra cash this year (say, from a bonus, inheritance, winnings, etc.)

- Want to secure a current charitable income tax deduction

- Want to make an easy gift you can repeat year after year

Keep in mind that while a cash gift makes the same impact on our work as other types of gifts, you may not want to make a cash gift simply out of habit. Other gifts can provide you with various types of tax and planning benefits that are worth exploring from time to time.

See how it works.

Jonah receives a modest inheritance from a relative. Since he has already decided to make a gift to Citizens & Scholars this year in almost exactly that amount, it is very simple to make an online donation of that inheritance money. We send Jonah the proper acknowledgment of his gift, and he uses that to secure an income tax deduction when he itemizes (subject to limitations).

Consider your timing.

If you want to qualify for a charitable deduction this year, you’re in luck—you can make a donation at any time up to December 31. Mailed checks must be postmarked by December 31—keep in mind that some post offices are closed on Saturdays and Sundays.

We can help.

If you are interested in exploring other gift options, please reach out to us. We are always available to discuss charitable gift planning and/or to send you helpful information.