Blended Gifts

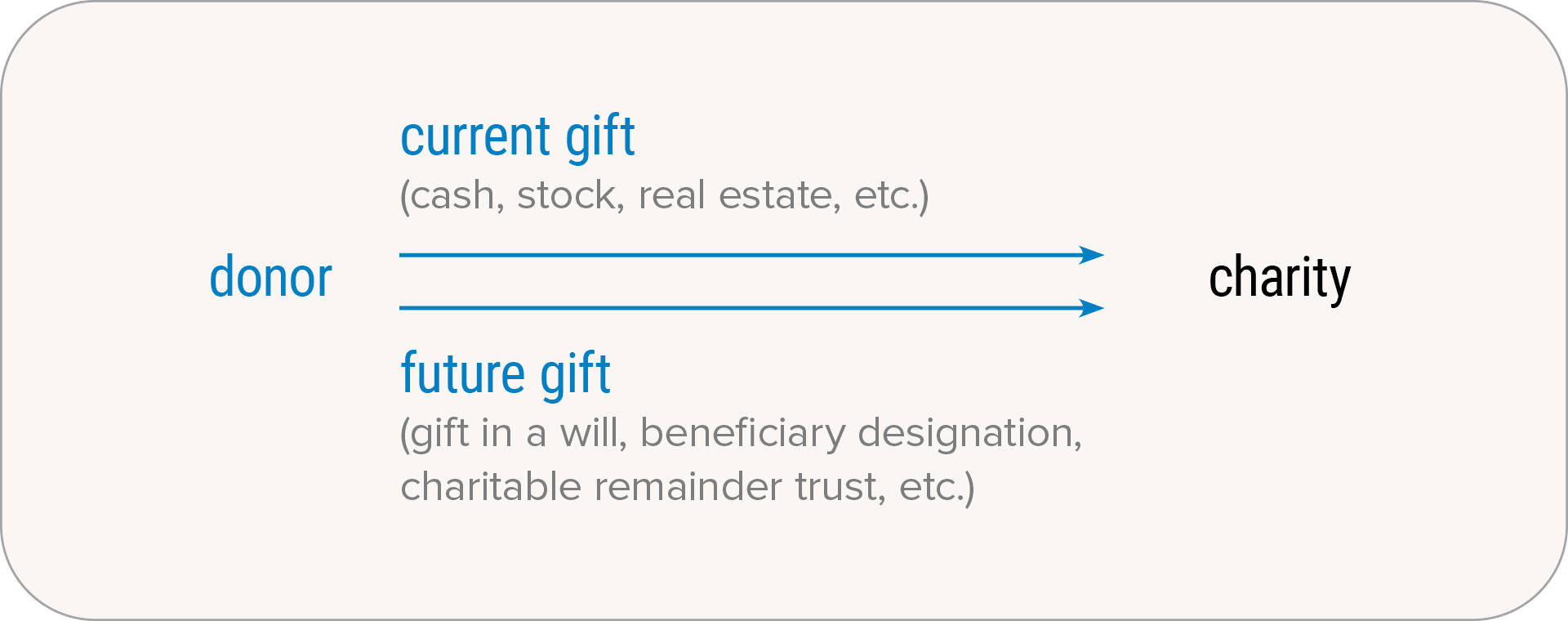

A blended gift is as versatile as it comes—any combination of two or more gifts (most often an immediate gift combined with a future gift) that provides us with powerful support and provides you with the particular benefits that work best for your situation.

A blended gift works like this:

- You review your assets and your charitable and financial goals.

- You decide on the combination of gifts that will best accomplish your goals and make the best use of your available assets.

- Your gifts help ensure the continuation and success of our mission.

Evaluate the fit.

A blended gift may be a particularly good option to consider if you want to:

- Enjoy seeing a current gift making a difference today while also having the satisfaction of implementing a future gift that is perhaps larger than what you’re able to give right now

- Tailor your gifts to meet your needs, since each type of asset can have a different impact on taxes as well as on personal planning, goals, and needs.

See how it works.

Mia consistently supports Citizens & Scholars with annual gifts. Now retired, she is pleased that she can make her annual gifts directly from her IRA to us. She pays no federal income tax on the distributions, which count toward her required minimum distribution amount. This year, Mia decides to take her giving one step further and name Citizens & Scholars as the beneficiary of her IRA. The funds are still available to her during her lifetime, but at death, whatever remains in the IRA will become a gift to support our mission.

Connor has enjoyed investment success and owns substantially appreciated stock. Connor donates stock valued at $50,000 to Citizens & Scholars. He pays no capital gains tax on the stock’s appreciated value and may qualify for an immediate charitable income tax deduction. Connor wants to make a much larger gift but hesitates because he is uncertain what the future might bring. He chooses to make a second gift to us in his will, leaving us 50% of his estate, with the other 50% going to his grown son.

Consider your timing.

For a blended gift, the choice of assets and gift strategies will typically determine the timing of the gift.

We can help.

Blended gifts are unique. In fact, they are as unique as you are. We are happy to discuss your personal situation and goals and help you explore which combination of gifts might provide the greatest benefit for you and us.