A Gift of Stock

Appreciated stock offers powerful tax benefits as an outright gift or as funding for a life income gift.

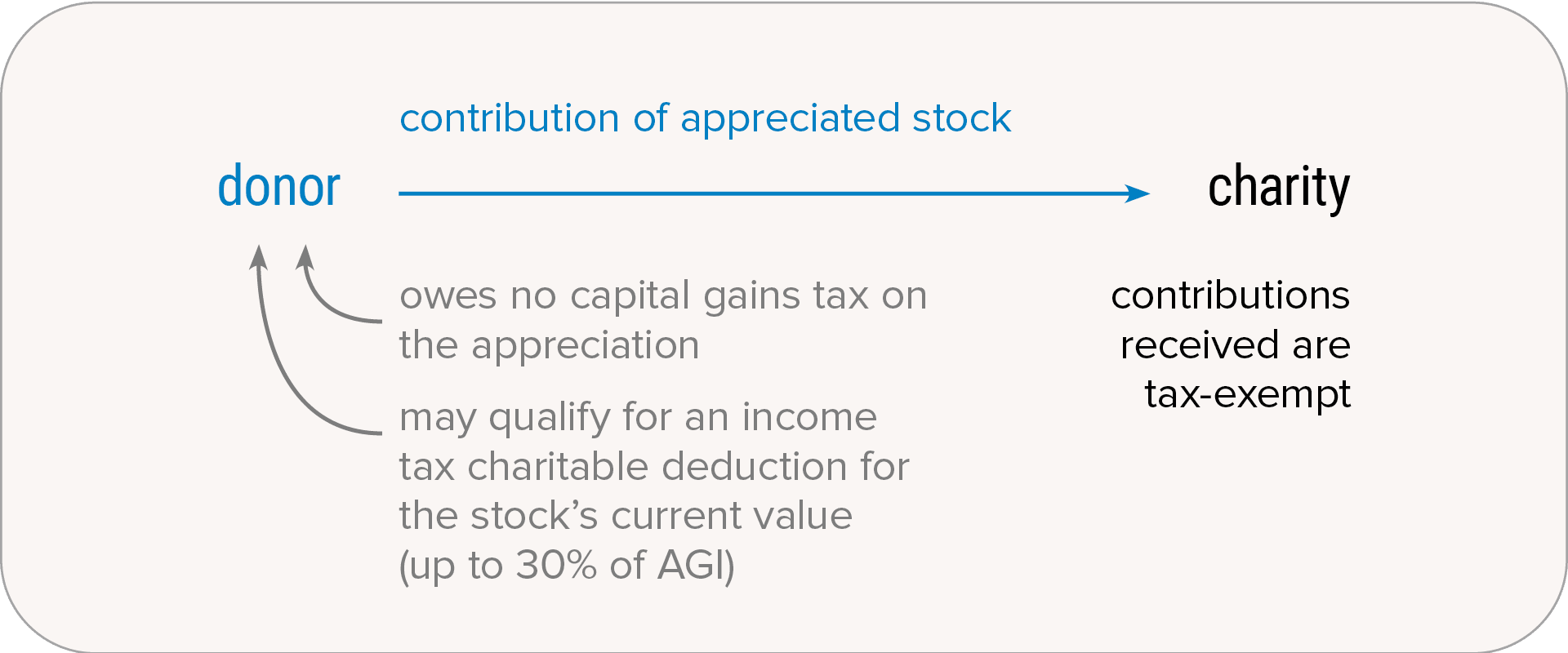

OPTION 1—an outright gift of appreciated stock

You may find that giving appreciated stock (held for more than one year) lets you make the biggest impact for the lowest cost. Consider the double tax benefit:

- You qualify for an immediate federal income tax charitable deduction for the full value of the stock if you itemize.

- You owe no capital gains tax on the appreciation.

Note that your charitable deduction for long-term appreciated stock is limited to 30% of your adjusted gross income. Any excess deduction can be carried over for up to five years.

Publicly traded stocks are the most commonly donated appreciated securities, but you could also give bonds, mutual fund shares, or closely held stock.

Selecting the best stock to give

The best choice depends on your portfolio, investment goals, and tax situation. General guidelines indicate that you might consider a stock:

- Held for more than one year (since that will allow you to deduct the full fair market value)

- With significant appreciation (since that will provide the strongest tax benefits)

- That will help you reposition your investments and rebalance your portfolio

- That lowered or cut its dividend

Note: If you want to give stock that has not appreciated in value, you benefit most from selling the stock, taking the tax loss, and donating the proceeds.

OPTION 2—funding a life-income gift with appreciated stock

Another option is to use appreciated stock to fund a charitable remainder trust. Benefits include:

- You qualify for an income tax deduction (if you itemize) in the year of the gift.

- You create an income stream to supplement other sources of retirement income—income that is likely to be higher than any dividends you might be receiving from the stock.

- You may be able to reduce or spread out the payment of capital gains tax on the appreciation.

Evaluate the fit.

Appreciated stock may be a particularly good option to consider if you:

- Have stock you want to sell, but you don’t want to pay capital gains tax on the significant appreciation

- Want to rebalance your portfolio

- Want to employ one of the most powerful gifting options with double tax benefits

See how it works.

For the past few years, Jennifer has given us a check for $10,000. This year, she realizes that the growth of some of her stocks has caused her investment portfolio to become too heavily weighted in equities. She decides to give us stock worth $10,000 that she purchased years ago for $1,000. If Jennifer itemizes, she may be able to take an income tax charitable deduction for the full $10,000, even though $9,000 of it has never been taxed. In her 37% tax bracket, the tax savings are substantial.

| Gift of Cash | Gift of Stock |

Jennifer’s gift | $10,000 | $10,000 |

Income tax savings (37% tax bracket) | $3,700 | $3,700 |

Capital gains tax savings (23.8% of $9,000) | -- | $2,142 |

Tax savings generated by Jennifer’s gift | $3,700 | $5,842 |

Consider your timing.

If you want to qualify for a charitable deduction this year, you should initiate the stock transfer by Monday, December 22, 2025. You can also give mutual fund shares, but these gifts take longer—initiate by December 1 to ensure sufficient time for a year-end gift.

We can help.

We can provide you and your advisors with the information you need to choose a gift with maximum benefits, including an illustration that will clearly represent the anticipated financial and tax benefits of your hypothetical gift.